In an article published last week here on the site, Graeme Sewell of Webcertain alluded that 2013 could signal the beginning of the end of the PC and the end of the beginning of the tablet. The reasoning behind his statement was that global PC shipments saw a year-on-year decline in Q4 2012 for the first time in more than five years, meanwhile tablet shipments continued their spectacular upward trajectory. If current numbers hold up, tablet shipments are on course to surpass those of PCs by the end of the year, wrote Graeme.

This development, the transition from PCs onto mobile devices, is directly reflected and supported by comScore’s most recent qSearch analysis (widely considered the most reliable source in terms of tracking the global search engine market), which saw the total global number of PC searches decline by 4.6% in December 2012, compared to the corresponding period in 2011. More interestingly perhaps, comScore already started reporting year-on-year declines in traditional desktop searches back in September 2012, thus giving greater reason to believe that we are dealing with a sticky trend, rather than an isolated event.

The decline is particularly interesting because it has occurred amidst a period of rapid internet uptake, with a whopping 250 million new users accessing the internet in the past 12 months, according to WeAreSocial. A big chunk of this growth, however, is being driven by emerging markets where mobiles are often the primary, if not the only gateway to the internet. Hence, this may very well explain the miniscule impact it has had on global desktop searches, if any.

Surely, the prolific use of smartphones and tablets as a means of accessing the internet, hereunder conducting searches, is disrupting search as we know it at an unprecedented pace. In certain verticals, mobile traffic already accounts for around one third of all searches, whereas the figure across all categories is expected to be somewhere between 10-15%. No doubt the industry is standing at an inflection point which in many ways bears resemblance to the early days of the internet. Nonetheless, these figures still suggest that, despite the rightful buzz about smartphones and tablets, the desktop remains the most important channel in most verticals for driving traffic and conversions – at least for the time being.

So without further ado, let’s dive into the specifics to see how the top 5 global desktop search properties have performed in 2012, using comScore’s most recent qSearch data.

Judging from the figures, it has been an eventful year indeed.

US search engines have all witnessed notable desktop declines in 2012

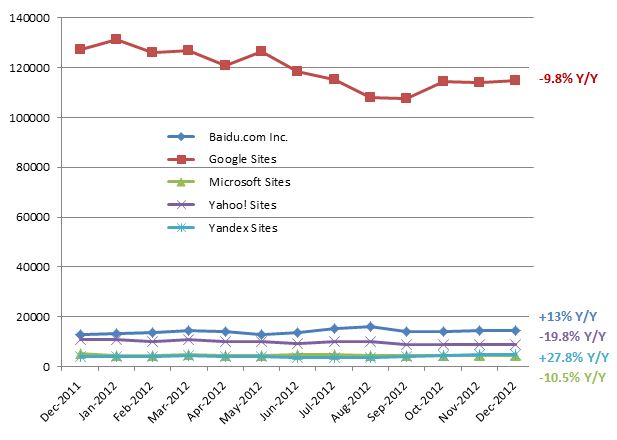

Google, Bing and Yahoo all saw year-on-year decreases in desktop searches, with Yahoo experiencing the by far steepest decline as the amount of searches plummeted by a concerning 20% year-on-year. Although more modest than Yahoo, global market leader Google also saw a notable drop of nearly 10% Y/Y. Desktop searches on Microsoft sites amounted to 4.12 billion in December 2012, down 10.5% compared to December 2011.

Unlike recent data from the GlobalWebIndexIndex, which suggest that mobiles and tablets are extending the social networking experience rather than replacing the PC, it appears that when it comes to search, mobile does seem to effectively replace some searches – notably those with local intent – that were previously conducted on the PC. In other words, mobiles and tablets are supplementary to a lesser extent in search than social networking.

Source: comScore qSearch

Yandex and Baidu resilient

Local search stars Baidu and Yandex, however, have managed to counter the desktop headwind and, in fact, increase the number of searches by 13% and 27.8% respectively. Admittedly, they also both have the advantage of operating in exponentially growing internet markets where growth is surging to an extent that is bound to reflect positively on performance – shift to mobile or not.

Baidu solidifies second place… but it faces increasing domestic competition

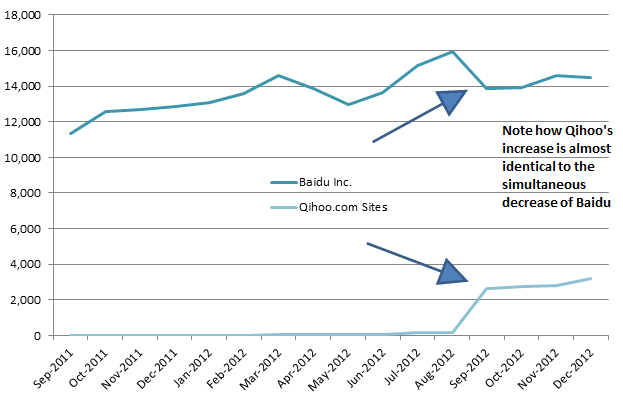

Baidu’s desktop increase, combined with the steep decline of Yahoo, means the Chinese search behemoth has solidified its position as the world’s second largest search engine over the course of the last 12 months. But now is surely no time for complacency. For the first time since Google pulled out of mainland China back in 2009, Baidu is facing serious competition from domestic rival, Qihoo. In fact, Baidu’s year-on-year increase of 13% would have been notably larger had Qihoo not stirred up the Chinese search market in August 2012 in a move which saw the internet company capturing an incredible 10% of the lucrative search market literally overnight (see spike in graph below).

What is even more interesting is the fact that Qihoo has managed to grow its share even after Baidu struck back; something that has resulted in analysts downgrading Baidu in concern that Qihoo poses a valid threat over the long-term, simply because Baidu’s sheer fiscal muscle power so far has proven insufficient to wipe off its now biggest contender.

Source: comScore qSearch

Moreover, just to add a little extra perspective on the impressive growth of Qihoo; the amount of searches Qihoo processed in December 2012 equalled those carried out through Amazon and Facebook – combined!

Yandex surpasses Microsoft sites

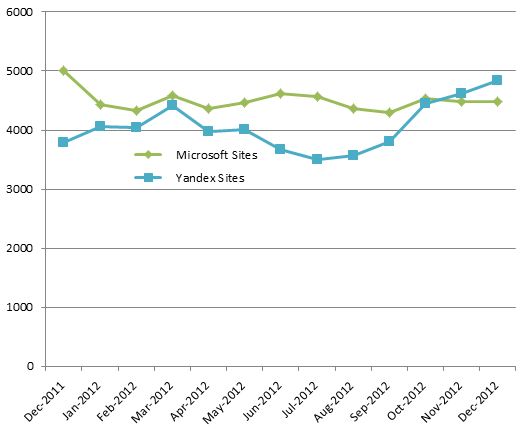

While difficult to see in the top graph of the article, when looking at Yandex and Microsoft in isolation, it shows how Yandex in quite spectacular fashion has managed to surpass Microsoft search entities in 2012. Apart from Bing, accounting for more than 90% of total searches via Microsoft Sites, these entities include MSN, Hotmail, Windows Live and a few others. Yandex on the other hand only has its search engine categorised by comScore as a search entity, yet it has outperformed Bing et al. with a strong performance, up 27.8% year-on-year and thus advancing to fourth place globally. This also indicates that Yandex yet again has managed to keep Google at bay, despite its many attempts to conquer the lucrative Russian market.

On a different note, it also leads one to wonder whether Microsoft’s so-called great splash with Bing in the year gone by – be that deeper social integration with Facebook or a neat design revamp – has had little to no impact?

Source: comScore qSearch

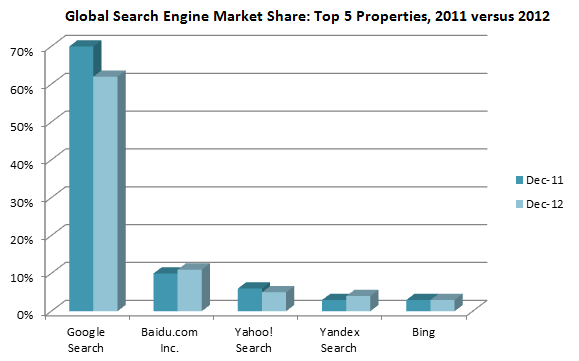

Google remains the undisputed global search champion… but it is not all plain sailing

With nearly 115 billion monthly desktop searches processed in December 2012, Google unsurprisingly remains the undisputed global search leader. Indeed, this makes the Mountain View-based company nearly 8 times bigger than distant runner up, Baidu. But unless Google sees a significant higher percentage of mobile searches than its rival search engines, it is not really news that should make Mr Page pop the champagne.

Having said that, it is not unthinkable – far from it in fact – that this could prove the case thanks to the widespread global adoption of Android and following setting of Google as the default search option on those devices running the OS. Whichever is the case, Google has seen its global desktop search market share plummet by 8 percentage points over a period of just 12 months, as shown below:

Source: comScore qSearch

With mobile searches increasingly making inroads into total search traffic, Google’s main concern has revolved around monetising the channel as the mobile cost-per-click metric has demonstrated comparable lower returns to that of desktop. But the search leader may just have found a way to increase the profitability of mobile clicks.

Coming into effect from the middle of this year, Google will not allow advertisers to buy ads strictly for desktop, nor will mobile only be an option, reports Business Insider. The push is bound to bring more advertisers to the mobile platform – whether they like it or not – thus resulting in increasing competition and, as a result, higher mobile CPCs. This also sees a shift to a more holistic and integrated approach that sort of merges the different channels, rather than treats them separately. Will other search engines follow suit?

Wrapping it up

The overall decline in global desktop searches emphasises the behaviour shift to multichannel. While desktop remains the most important in terms of scale, the amount of business you will leave on the table by solely focusing on this channel is more than evident.

From the perspective of the search engines, 2012 has been all about transitioning themselves for the mobile future. 2013 will be about monetising it. And those who do the best job at this are undoubtedly steering for glory in the disruptive times ahead of us.

Now over to you! Are you surprised by any of the findings? Will Yahoo somehow find its way back into the game under the leadership of former Googler, Marissa Mayer? Will Baidu be able to weather the increasingly competitive environment in its domestic market? And similarly, does Yandex have what it takes to keep the big G at bay once again as Google is likely to intensify its focus on the rapidly growing Russian market?

Immanuel Simonsen

Latest posts by Immanuel Simonsen (see all)

- Is Baidu losing its crown in China? - July 31, 2015

- Global logistics brand DHL eyes Chinese e-commerce growth - July 27, 2015

- VKontakte To Launch Rival To Instagram - July 21, 2015