With a population that exceeds 1.3 billion, you’d think Chinese businesses have their hands more than full catering to this market alone. While this happens to be the case for most companies, China’s leading tech forces are increasingly eyeing expansion opportunities beyond the country’s domestic borders to keep up past years’ exponential growth rates.

With a population that exceeds 1.3 billion, you’d think Chinese businesses have their hands more than full catering to this market alone. While this happens to be the case for most companies, China’s leading tech forces are increasingly eyeing expansion opportunities beyond the country’s domestic borders to keep up past years’ exponential growth rates.

Certainly, if you are to judge from the statements made by a wide array of China’s top tech CEOs, most of these companies aren’t falling short on their global ambitions. So far though, moves made into international territory by online giants such as Baidu, Tencent and Alibaba, have been sporadic and indecisive. However, considering the unprecedented growth that has taken place in the online sphere over the past decade in China, who could really blame them for focusing almost exclusively on their rapidly evolving domestic market?

The most recent estimates put China’s online population at a whopping 600 million, making it the world’s by distance largest online market by user count. Albeit impressive, if you do the maths, this actually paints a picture of an online market that is anything but saturated, with more than half of the country’s population having yet to come online.

This, however, hasn’t stopped UCWeb – China’s most popular mobile browser – from recently announcing an international offensive in which the company is planning to invest RMB 3 billion ($488 million) over the next three years in an attempt to gain a similarly dominant position in vast emerging markets such as India, Brazil, Russia, Indonesia and Vietnam, the Financial Times reports.

UCWeb’s “modest” objective, the FT further notes, is to acquire 1 billion users by 2016, of which half should come from outside of China. This would mark an increase in new users of 150 %, up from 400 million today (300 million domestic users; 100 million international).

Indeed, this ambitious international bet by UCWeb poses the interesting question of whether we’ll soon see other big Chinese tech players follow suit with full-blown international market entries?

To answer this question, we’ll have to look towards two emerging developments, which essentially are working against each other when it comes to deciding whether to pursue international expansion or not.

1. Decreasing internet growth rates encourage international expansion

Despite the vast growth opportunities that still exist, prior years’ precipitous surges in internet penetration have come to an end. In its comprehensive 31st statistical report on the development of the Chinese internet, CNNIC (China Internet Network Information Center) concludes that internet user growth has decelerated rather notably over the past year and is expected to further contract going forward.

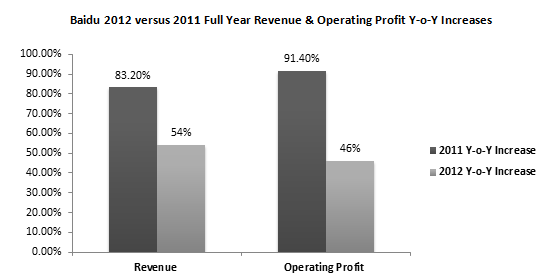

A comparison of Baidu’s 2011 and 2012 full year financial results support this trend (note: in this specific case there are other external factors, such as increasing domestic competition, that have impacted on Baidu’s performance; however, it’s still indicative of a cooling domestic internet climate).

Annual revenue and profit increases of around 50% would probably excite most business execs, but in Baidu’s case it’s actually an alarming development compared to the prior year. And while year-on-year growth deceleration is inevitable as markets mature, a continuation of this development would make a compelling case for international expansion.

2. When you’ve got something very valuable, you should hold on for dear life

A maturing market, on the other hand, also implies intensifying competition, market sophistication and rising consumer trust – ultimately creating a foundation on which ecommerce can flourish.

The potential of Chinese netizens’ rapidly improving consumer trust in ecommerce is certainly not lost on multinational companies in the West. In fact, most of them have realised that they simply cannot afford to ignore China unless they want to see the competition sail away with the prize. The move, however, is complicated — and in some cases even made impossible — by a protectionist government that heavily favours the well-being of local Chinese businesses.

These high barriers to entry are slowly eroding though, meaning that Chinese companies sooner or later will have to allocate more resources to defending their home turf from being overtaken by eager aspirants from abroad looking to capitalise on the financial goldmine that China truly is.

These two developments combined — decelerating internet growth rates and increasing interest in online China, particularly from abroad but also at home — put leading digital Chinese companies in somewhat of a dilemma: To go global to counter cooling domestic internet growth? Or to keep all troops within the borders of China to focus fully on keeping foreign and domestic competitors at bay and tap the vast potential that has, rightfully, yet to be tapped?

UCWeb aims for both, and I have a funny feeling we’ll see similar ambitious moves from other Chinese tech giants soon enough – if not this year, then in 2014.

Immanuel Simonsen

Latest posts by Immanuel Simonsen (see all)

- Is Baidu losing its crown in China? - July 31, 2015

- Global logistics brand DHL eyes Chinese e-commerce growth - July 27, 2015

- VKontakte To Launch Rival To Instagram - July 21, 2015