Ecommerce and shopping online have become something of the norm in the past couple of years, and this holds true all over the world. It’s a digital age, and some businesses might have more difficulty than others getting used to it meanwhile consumers increasingly prefer the simplicity of sitting behind a computer to complete their hopping needs.

Ecommerce and shopping online have become something of the norm in the past couple of years, and this holds true all over the world. It’s a digital age, and some businesses might have more difficulty than others getting used to it meanwhile consumers increasingly prefer the simplicity of sitting behind a computer to complete their hopping needs.

The UK boasts one of the world’s largest ecommerce sectors, but how are some of the big players like Tesco, Apple and Thomson stacking up against each other when it comes to the number of keywords they target and the traffic they receive? And how do keyword volume and website traffic correlate?

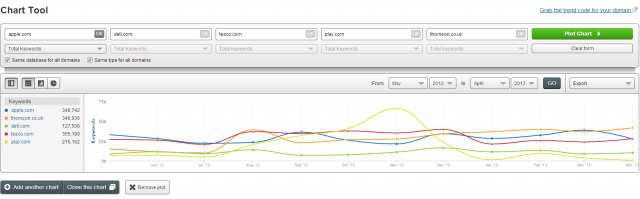

Chart Tool: Total Keywords

As the SEMrush chart tool shows, all of these sites are within relatively close proximity for the total keywords they are bidding on. However, out of the five sites investigated, play.com – owned by Japanese gaming giant Rakuten – took the biggest jump around November of 2012 when they were advertising almost 66 thousand keywords (perhaps in preparation for the holiday season), since their keywords took a serious nose-dive in January to almost nothing and have remained there ever since.

Both Apple and Dell have remained rather steady with their keywords in the UK, with Apple allocating a few more budget dollars to their keywords than Dell for the duration. Tesco has stayed constant with their keywords for the course of the year, while Thomson.co.uk has increased quite exponentially. In July of 2012, the latter was employing approximately 11,500 keywords which has increased to 41,500 keywords in April of 2013; obviously, the travel industry is seeing some success with internet marketing and has continued to increase their investments as a result.

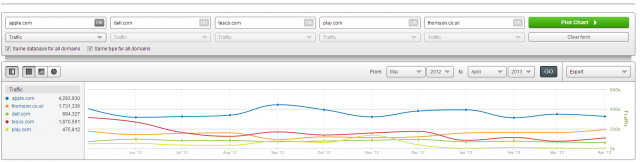

Chart Tool: Traffic

When it comes to search engine traffic, the chart shows that visits for each site have remained relatively stagnant for the course of the year. Also, take notice of how the lines correspond with the original keyword chart. Tesco went from 227 thousand visitors in June of 2012 to 135 thousand in October, and finally have plummeted to 107 thousand in April of 2013; this despite having maintained a rather constant keyword volume. Maybe they need to re-visit their marketing campaign and take a look at what their competitors are doing to help make a strategic business decision on which keywords they are bidding on.

Play.com’s traffic is practically non-existent. In June of 2012 they had about 50 thousand visitors – a figure that has declined steeply since November 2012. In looking closely at both charts, it can be seen that as play.com dropped down their keywords, their traffic followed suit (while when they had the most keywords at 66 thousand, they had the most traffic at 131 thousand).

As mentioned above, Thomson.co.uk increased their keywords, and their traffic has gradually begun to increase as well from 140 thousand to almost 200 thousand visitors per month in April. Dell remains constant around 100 thousand visits per month, while Apple has been sporadic with the lowest amount of visitors at 315 thousand and the most at 443 thousand in September of 2012 (when the iPhone 5 made its debut and when they had the most keywords with 36 thousand).

So what is next?

It is quite revealing to see how the keywords chart corresponds with the traffic for each of these UK ecommerce websites; and can help to make it clear what might be working with the strategies of each of these sites, and what might not. The next step in this situation would be to dig a little deeper, and all of these suppliers would benefit from doing a little bit of analysis of their competition to see what strategy might possibly bring them to find even more success within UK ecommerce.