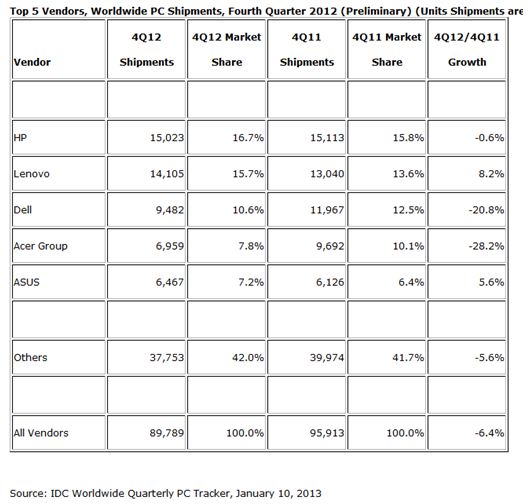

For the first time in over five years, global PC shipments saw a year-on-year decline by Q4 2012, according to IDC’s Worldwide Quarterly PC tracker. With 89.9 million shipments worldwide in Q4 2012, this meant a 6.4% decrease across all vendors, compared to 95.9 million in Q4 2011, with only ASUS and Lenovo making gains. Even the introduction of Windows 8 did little to boost PC sales, although perhaps hardly surprising when the more mobile and convenient tablet better appeals to current consumer habits.

By contrast, during the same time period, worldwide tablet shipments increased by 75.3%. Q4 2012 saw shipments increase to a record 52.5 million, compared to 29.9 million in Q4 2011, according to IDC’s Worldwide Quarterly Tablet Tracker, fueled by an expanding choice of products, including the iPad mini, 4th generation iPad, Google Nexus 7 and Microsoft’s Surface, which have also contributed to the decrease in average selling prices of rival products.

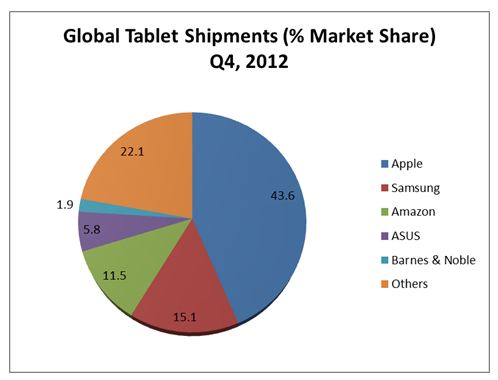

Apple continues to dominate global shipments by volume with 22.9 million units during Q4 2012, although the 48% increase compared to Q4 2011 is under the market norm. Increasing competition meant Apple actually had a year-on-year decrease in market share from 51.7% in Q4 2011 to 43.6% in 2012 during the same time period, which is only bound to benefit consumers and fuel further growth in the tablet market in the year to come.

With 7.9 million units shipped, Samsung are rapidly catching Apple with a 15.1% market share in Q4 2012, which represents a 263% increase compared to the same period last year. Amazon too saw an increase in volume shipments to 6 million units in Q4 2012, meaning they firmly cement 3rd place with 11.5% market share, followed by ASUS (5.8%) with their Google-branded Nexus 7 and achieving the highest year-on-year increase of 402% compared to Q4 2011.

Even though Microsoft did not make the top five vendors during the final quarter of 2012, with less than 1 million shipments in total, if they work to bring down average selling prices, which are currently comparable to Apple, we should see them make inroads into the competition during 2013. Given the stagnation of the PC market and muted uptake of Windows 8, their future may depend on a strong “mobile” performance.

Q4 2012 global tablet market share, according to IDC, shown below:

If tablet shipments continue to grow while PCs decline at the current rates, it will mean that global tablet shipments are set to exceed those of PCs for the first time ever!

Could 2013 signal the beginning of the end of the PC and the end of the beginning of the tablet? Let us know if you think the tablet will topple the PC – or not?