There is no doubt that the mobile ecosystem is rapidly evolving; infrastructure, Wi-Fi connection availability and connection speeds are improving. There are now more mobile broadband accounts than fixed globally, and during a recent presentation at Bloomberg, San Fransisco, Mary Meeker stated that she projects global smartphone plus tablet installs to exceed the install base of PCs by the end of Q2 2012.

The astounding rate of innovation in the industry is largely being driven by fierce battles between hardware producers, Operating Systems and software developers who are offering consumers a more diverse and rapidly advancing array of choices in order to conquer as much share of this attractive market as possible.

Ecosystems differ across markets

There are plenty of variables in the ecosystem for marketers to keep track of in their home market, however for those intending to market abroad, the ecosystems can differ markedly from country to country. According to comScore, Android has the largest market share in the UK with 36.6%. In Germany, however, Symbian is leading, at 52.8% – this despite a large decline globally. Could Germans really be that far behind the times!

On the other hand, RIM has also seen a demise of market share globally, yet ownership in the UK is still relatively strong with 18.3% share in 2011. Compare that to 3.3% and 4.9% in Germany and Italy respectively. Moving on to Asia, the by far most popular OS is Android, with a 60.5% share in Japan and a whopping 76.68% in China, according to China Internet Watch.

These kinds of statistics are important for app developers seeking to launch into other markets, since app stores are the main gateways for users to consume apps. Naturally, it makes sense to focus on the most important stores first.

The Apple app store is available in 136 countries worldwide, ahead Google Play’s 120 countries but soon to be surpassed by the new Windows 8 Marketplace, which will be available in around 180 markets. Evidently, App developers can with relative ease reach out to global markets.

Should developers translate their apps?

An early consideration for app marketers and developers must be: is it worth translating our app? This might be guided by the type of app. For a visual app such as a game or widget, for instance, it might not be a priority to translate. However, given that app store algorithms are set to become more advanced as time goes by, the English app might never get found among its native competitors.

Highest growth occurring in non-English speaking markets

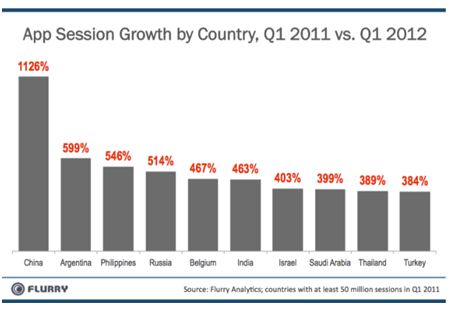

In Q1 2012, China became the global leader in terms of smartphone adoption and compared to Q1 2011, saw an incredible rise in app sessions by 1100% (see graphic below).

Whilst developers and marketers might get excited by this, without investing in an app localisation program, it might never get off the ground. According to Cambridge University Press, a mere 0.83% of the population in China speak English as an additional language, equating to around 10 million people. By comparison, there are more English speakers in Spain and Iraq! In fact, in the top 10 countries of App session growth, English is only an official language in India and the Philippines.

Localisation does impact on downloads and revenue

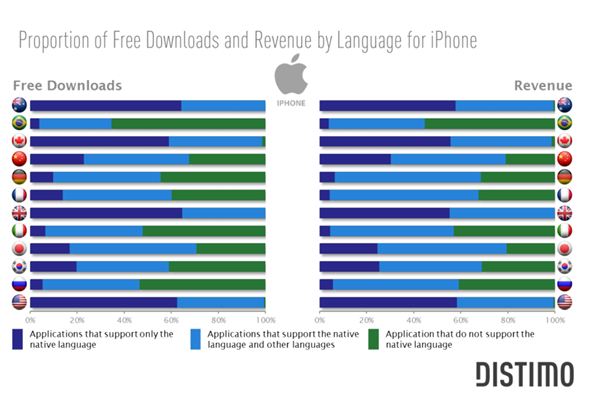

Additionally, an interesting study by Distimo looked at a sample of 200 apps (Apple apps only) across eight countries where English is not an official language. These apps all introduced a native language in August 2012. Results? A week after the localised versions were launched, iPhone app data found that downloads increased 128% and revenue increased 26% on average, compared to the week before. The largest increases in revenue were recorded in China and Germany, which suggests users in those countries are particularly keen to pay for apps in their native language.

More bang for the buck with localised iPhone apps?

Perhaps what is surprising is that their analysis found that, over the same period, downloads for translated iPad apps saw no significant increase at all and revenue increased by 5%. At face value, this might seem like iPad apps are not as important to localise. Distimo did not publish the types of app per country, what proportions are free versus paid, or specifically how many apps were chosen for either device. However, these findings clearly suggest that localising apps can only have a positive impact and must be a primary consideration for developers and marketers in the rapidly evolving and increasingly competitive Mobile ecosystem.

Do you have any experience with app translation and localisation? If so, I would like to hear about the results and what you perceive to be important considerations when tailoring an app to local preferences. Have you also found any discrepancy on the impact of iPhone and iPad app localisation?