Rarely has Baidu’s disclosure of its quarterly financial results been awaited with such anticipation as has been the case for Q3 2012. Plenty of unknowns were to be answered, but one question in particular stood out compared to previous quarters: To what extent would Baidu be able to weather the increasingly competitive Chinese search environment?

I will try to answer that question later, but first let’s start with a bit of context (if, however, you are already familiar with Qihoo and the company’s entry into the Chinese search market, I suggest you skip this first part and start reading from “Qihoo & Baidu – Not The Best Of Friends”).

Qihoo who?

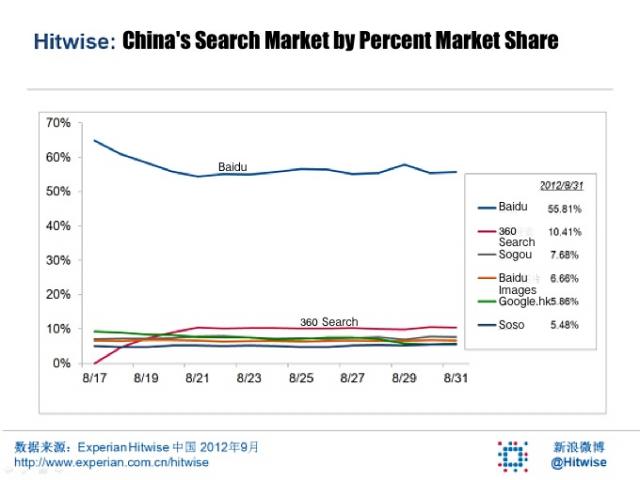

The Chinese search landscape was properly stirred up in August earlier this year following Qihoo 360’s entry into the lucrative Chinese search market, in which 360 Search, as its search engine is dubbed, managed to capture 10% of the market literally overnight – enough to make it the second largest search player of all in China:

How is such an astronomical leap even possible over the course of a couple of days, you may ask? After all, we are dealing with a highly competitive vertical in the world’s largest internet market (by user count).

Well, in addition to now offering search, Qihoo 360’s product portfolio counts one of China’s most popular internet browsers, used by a whopping 272 million Chinese netizens, according to iResearch.

This, almost single-handedly, paved the way into the Chinese search market by setting 360 Search as the browser’s default search engine, underlining the vital role proprietary browsers play in the quest for fame and fortune in search.

Qihoo and Baidu: Not the best of friends

Interestingly, as shown in graphic above, Qihoo’s launch of 360 Search and subsequent 10% gain came largely, if not entirely, at the expense of almighty Baidu. Positively for Baidu, however, it seems that the share of its now biggest competitor has plateaued at around 10% after its initial surge.

Now, if you think China’s leading search company has passively watched Qihoo eating into its share, think again. Following the launch began a heated battle between the two, where Baidu striked back by redirecting all 360 users to the Baidu homepage when they tried to use Baidu’s own products (Baidu’s spike on 29 August shows the effect of this). Qihoo then almost immediately responded by using cached Baidu pages, something which appears to have prevented 360 Search from any loss in market share.

The times they are a-changin’… Or are they?

Baidu has commanded 75-80 percent of the Chinese search engine market for some time now. Ever since Google pulled out of the mainland and relocated its servers to Hong Kong back in early 2009, resulting in a steep decline in market share, Baidu has steadily solidified its stronghold Heck, as of October 2012, Google holds a mere 4.72% of the market compared to +30% in its glory days, reports CNZZ.

Add to this that local players like Sogou and Soso have not managed to move the needle much during this period, if at all. For this reason, going back to my opening question, the competitive landscape has not played much of a factor when discussing Baidu’s financial performance and the challenges facing the company and its continuous growth. But oh boy, did that change with Qihoo’s launch of 360 Search.

While the transition from PC to mobile and the macroeconomic headwind in China both continued to be considered decisive factors for Baidu’s overall performance, there was one thing concerning analysts more than anything else; that thing was the extent to which the increasingly competitive climate – Qihoo’s entry in particular – would affect Baidu.

Okay, so enough of the chatter; how has it actually affected Baidu? Is its desktop search monopoly finally starting to wane?

Let’s take a brief look at its third-quarter results.

Baidu demonstrates strong customer acquisition

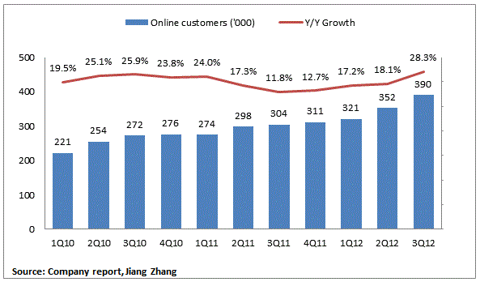

Despite increasing competition, a reported 9-10% drop in market share, and a weakening macro economic climate, Baidu demonstrated extremely strong customer acquisition. Even with the odds against them, the Chinese search behemoth managed to grow its customer base to 390K, up 28.3% Y/Y (the highest annual growth rate of all listed below). Moreover, the average revenue per customer rose by 16.8% year-on-year to $2,546.

Although it has to be said that Baidu continued to invest heavily in training and its sales team during the third quarter, it seems to me that the latter deserves an early Christmas gift this year.

Total revenue and operating profit increased by 50% over the corresponding quarter last year. While the 50% year-on-year revenue is below what we have seen in the past, this has to be expected as the market evolves and gradually matures (although there is still a vast growth potential yet to be tapped with internet penetration sitting just below 40%). However, the fact that Baidu landed in the soft end of the company’s revenue projections for the quarter could also be due to 360 Search’s great splash, but in the larger scheme of things its impact, at least financially, seems minimal.

It does not necessarily have to remain so going forward, though. The new kid in town certainly has come with the intention to play and manifest itself as a force to be reckoned with. In this regard, Qihoo CEO Zhou Hongyi recently told Chinese media that it aims for 15-20 percent of the market and that they have hired former Google employees in their pursuit of achieving this target.

Still, if I were to bet my money on a potential outcome, I would go with the one that has got +10 years experience in search, a strong brand reputation and user familiarity, and last but not least a great deal of economic muscle-power to make life very difficult for anyone challenging its turf.

Want to know more about the search landscape in other “high-potential” markets? Download Webcertain’s brand new Global Search & Social Report 2012 providing the freshest data on 34 individual countries. It is free to do so!