For some years we have talked about BRIC countries as being amongst the most interesting for international search marketers to target. It was always inevitable that at some point we would need to come up with a new term and to look at new geographies – especially when one of the emerging markets (China) is already the world’s second largest economy.

A variety of approaches have been put forward but I believe the most useful candidate for web marketers is currently “CIVETS” as we know from our work – and our discussions with search engines – that these markets are being very closely watched.

These are the CIVETS countries:

- Colombia

- Indonesia

- Vietnam

- Egypt

- Turkey

- South Africa

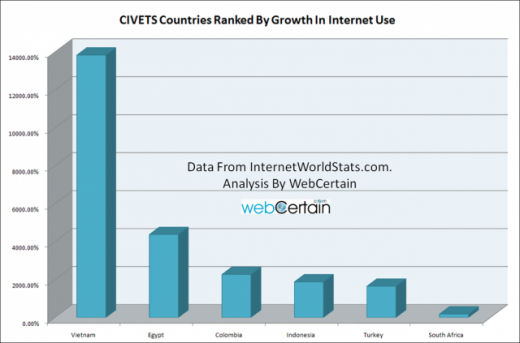

As the above chart shows, you can see that what is particularly interesting to search marketers is the rate at which these nations are taking up the internet – and the figures understate the picture because the growth rate is the average over the last decade. However, growth has been accelerating in some of these markets so these numbers are cautious.

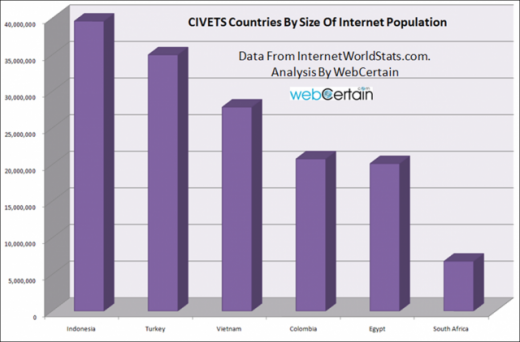

The CIVETS are equally not small in terms of total numbers – this is not a case of a few nations with very rapid growth from a very small base giving us a very rapid growth rate in percentage terms. Between them as it stands today, the CIVET countries offer 150 million extra internet users – that is more than Russia or Germany or any European nation on its own.

Of these the largest current opportunity is Indonesia which is already approaching 40 million internet users – yet less than one fifth (16.10%) are actually online today! Turkey, which is the most engaged nation in Europe after the Dutch, already has 35 million online – though with a more advantage connectivity ratio of 44% of the population online.

In all of these markets currently, Google is the most significant search engine – but that might well change very rapidly thanks to the growth rates themselves giving competitors the opportunity to ride a wave if they choose the right moment and product to enter the market.

Let’s take a look at some quick economics

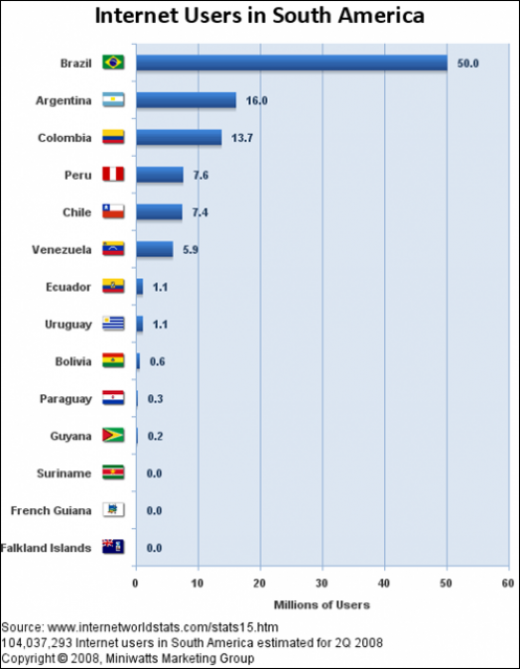

Colombia is perhaps a surprise in view of its record at home with terrorist groups however, with a steady leadership, the country has been making progress and has growth, strong inward investment, modest inflation and debt. In 2007 it had a growth rate of 8.2% which and was one of the fastest growing economies in South America. 20% of its population, many of which are online, own a disproportionate amount of the wealth in the country according to the UN, benefiting from a 63% share of the countries incomes. The total GDP is around $430 billion.

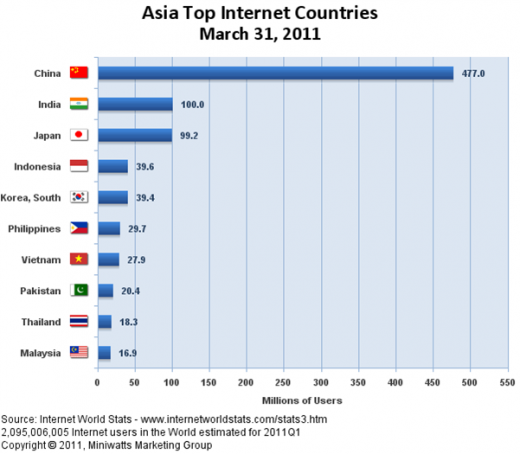

Indonesia is a vast and large country and has been seeing strong economic growth with 4.4% in 2010. The country is one of the G20 countries which meet regularly to oversea world economic decisions – and Indonesia is certainly the largest nation in South East Asia. The GDP is round $707 billion estimated and the President of Indonesia has boldly said that the nation will be in the top ten economies within a decade.

Vietnam is also in South East Asia and whilst it is not as large, it is doing pretty well economically with an 8% growth in GDP for the years 1990 to 1997 – a remarkable pace of growth and it remains one of the world’s fastest growing economies with a 6.8% growth rate in 2010, though it has suffered relatively high inflation at 11.8% in December 2010. Vietnam is also proud of its record as one of the most welcoming South East Asian businesses for foreign investment and doing business.

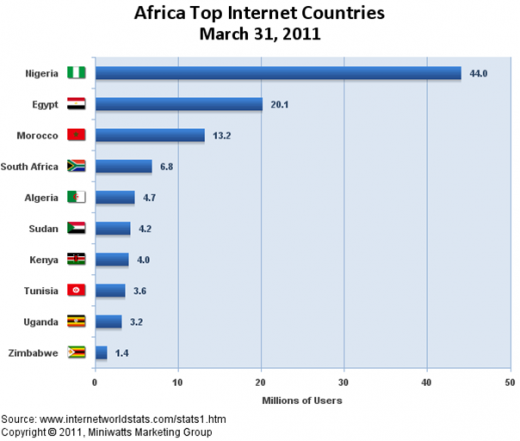

Egypt brings us to the Africa continent and the nearest one of field to the Middle East. Clearly Egypt has had its recent troubles however it has received strong foreign aid for many years enabling it to invest in communications and infrastructure. Tourism is an important market – and of course it also generates revenue from the Suez canal – a key link for European shipments to and from the East. The recent troubles have inserted some uncertainty into the market short term – but Egypt is expected to ultimately sail out of its current state – at least from an economic point of view. The time to invest is really now.

Turkey is a personal favourite of mine thanks to many visits to many parts of the country and it should certainly be high on anyone’s list of target markets. It offers a large market and relative stability. Turkey is a founding member of the OECD and also a member of the G-20. Average growth between 1981 and 2003 was 4% of GDP despite a few economic setbacks along the way and in 2010 it is believed to be achieving an 8% rate of economic growth.

South Africa has the African continents largest stock exchange and despite its long recovery from Apartheid, there is still considerable poverty in the country – but this is despite a nation which is rich in natural resources and generating good revenues from tourism. The recently constructed Nelson Mandela Bridge in Johannesburg is claimed by some to generate 33% of South Africa’s GDP and 10% of that in Africa. It crosses over 40 railway lines and has received vast economic investment. South Africa’s GDP ranks it 25th in a world of over 170 nations.

Sources: