Last week on the SMX conference in Paris we had a keynote discussion and I may have been a little quick when I stated that “Search Marketing in France has a 100% growth potential”. I was not contradicted, however, but I thought it would be useful to dig a little deeper to look at the state of search marketing in France.

Second biggest European economy but a weak number 3 in the Online Economy, France is actually half-way down to second division when it comes to Search Marketing. The market is one of those Google-territories with extreme domination (approximately 95%) of the Search Market – practically all local technologies have been wiped out (Nomade, Echo, Voila, Kartoo, Quaero). Google Domination is so strong that everybody stopped counting market shares a couple of years back.

So whereas the French population (65 million) is actually bigger than that of the UK (62 million) and the two almost have the same number of Internet users (50 million in France versus 53 million in the UK), when it comes to Search Marketing there is a tremendous gap as Search Advertising in France represents half of the amount it represents in the UK!

For many years we have been looking West to see what was going to happen on the Internet with the US market almost always showing the way, the UK following suit as the first European market and then the remaining markets following their path. If things were really that simple then we should expect the French Online Advertising market to grow significantly – say 100%

Online advertising is smaller and search less mature

Digging into the figures of online marketing it quickly becomes apparent that the budget volume of Online Advertising is the first direct reason for Search Advertising to be so much smaller in France. Let’s have a look at figures from 2010 where we have the most complete picture:

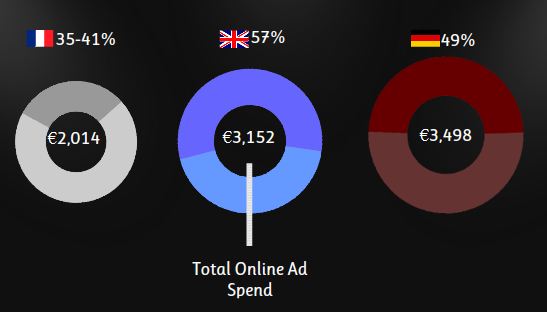

Online Advertising in France was estimated at a little over 2 billion euros for 2010 by McKinsey and a bit higher at 2,3 billion euros by a French study performed by Cap Gemini . Compared to the estimated 3,2 billion for United Kingdom or the 3,5 billion euros for Germany, there seems to be a much smaller online ad-space in France compared to the size of the economy. This in turn might be connected with either the smaller ecommerce sector or more generally with a lesser online maturity (lower internet penetration, more recent take-off) or simply less competition and consequently lower CPCs. I would add to this that this year’s predictions for growth in Search Marketing (11% by SRI) do not help closing the gap.

So a strong increase in Search Marketing in France would require a strong development of ecommerce. It would also require Advertisers to increase the share of Search Marketing within Online Advertising (35-40% in France in 2010) to grow to a level closer to that of the UK (57%) or Germany (49%) – this latter effect being a matter of market maturity. Apparently Search has not penetrated as much as in many other economies. With the strong development of Performance Display an Real-Time Bidding, however, there is no guarantee that this will happen. As an anecdotal element, the French market has been explained to me as one with a Great Tradition for Display as opposed to a strong tradition for Call-to-action in Anglosaxon Advertising markets.

There is likely to be another couple of reasons for the smaller Search Market. In past years I have seen many international campaigns run out of the UK due to a high concentration of Corporate Headquarters for multinationals in London. This would mean that a lot of the Search Advertising budgets are in reality not invested for the UK market itself. Another very good reason is perhaps the fact that Search Advertising is much more profitable in a market where conversion rates for ecommerce is higher. According to elements presented by Google at a recent “Think with Google” event, it was stated that Conversion rates where 60% higher in the UK than in France. For the same budget, a French advertiser would get a significantly lower return on investment and as such would not be able to justify as much Search Advertising expenditure as his British counterpart.

We can conclude that there is indeed a potential for the French Search Advertising space to grow tremendously but it probably will not happen unless French consumers get more comfortable with online purchases so we can see conversion rates go up. Ecommerce would need to grow significantly as a consequence. Such a significant growth could include expanding beyond the borders of France to compete abroad. There would also need to be a continued penetration Search Marketing as a proportion of all Online Advertising but in this task both RTB Display, Social Media and Mobile Advertising are very dynamic segments Search Advertising would need to outpace. We may have to live with only 2 digit growth figures for a while still…

i) Source Digest; MAGNAGLOBAL; McKinsey analysis

ii) Observatoire de l’e-Pub, SRI Cap Gemini 2012

iii) Source: IAB, via AOP, April 2011