As you can probably imagine, Webcertain collates a lot of data on global markets. Today marks the first release of our quarterly Budget Allocation data which examines how marketers are moving their online marketing priorities from region to region.

The data shows the allocations of SEO, SEM and social campaigns by region globally considering hundreds of client inputs and bringing together data on over 100 of the world’s regions. What it does not show is increases in actual spend as this would tend to show growth everywhere, rather than truly comparing how all budgets, including existing ones, are allocated.

The most remarkable finding in the data is just how closely political and economic events affect the routes to markets chosen by globally-focused US and UK companies, who comprise the vast bulk of the data.

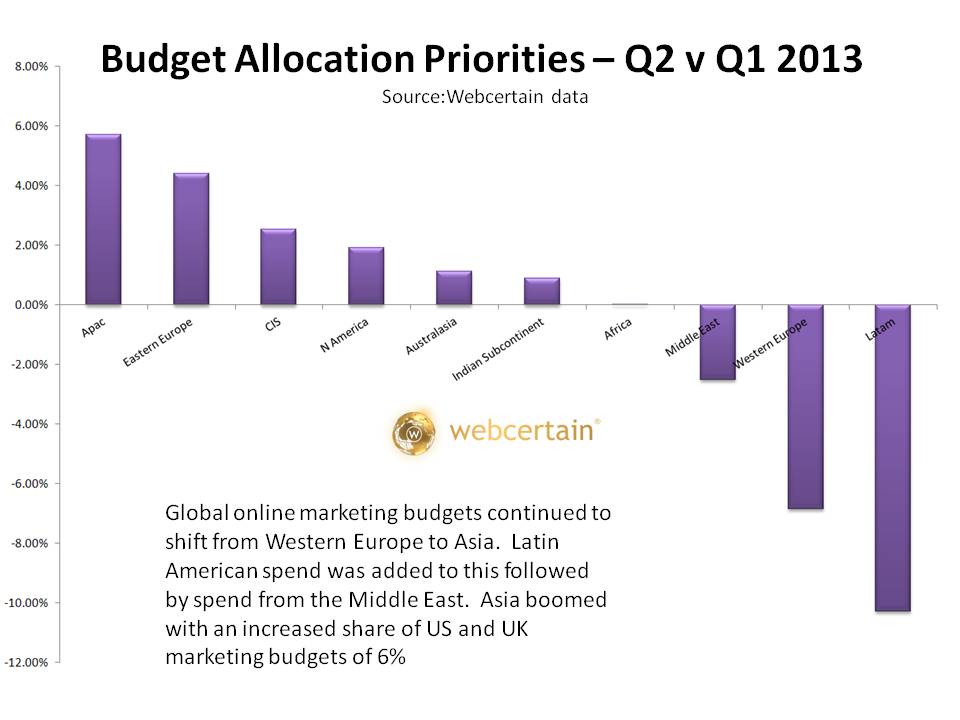

Looking at the global picture, in the chart above, we see that Latin America, Western Europe and the Middle East have seen the greatest re-allocation of their budget shares and that this money is headed east, to the Far East in fact.

En route, the Indian Subcontinent, Australasia and North America have picked up small shares, but the bulk of the money is landing up in Eastern Europe, the former CIS states and Apac. Indeed, Apac effectively received a 6% re-allocation of budgets between the two quarters which represents significant movement in such a short time frame.

Clearly the macro-economic environment and political situation is having a significant effect and because “online” represents a much easier environment in which to move resources quickly from region to region, the budget flows are rapidly mirroring the outside world – as we will see as we examine each individual region in more detail.

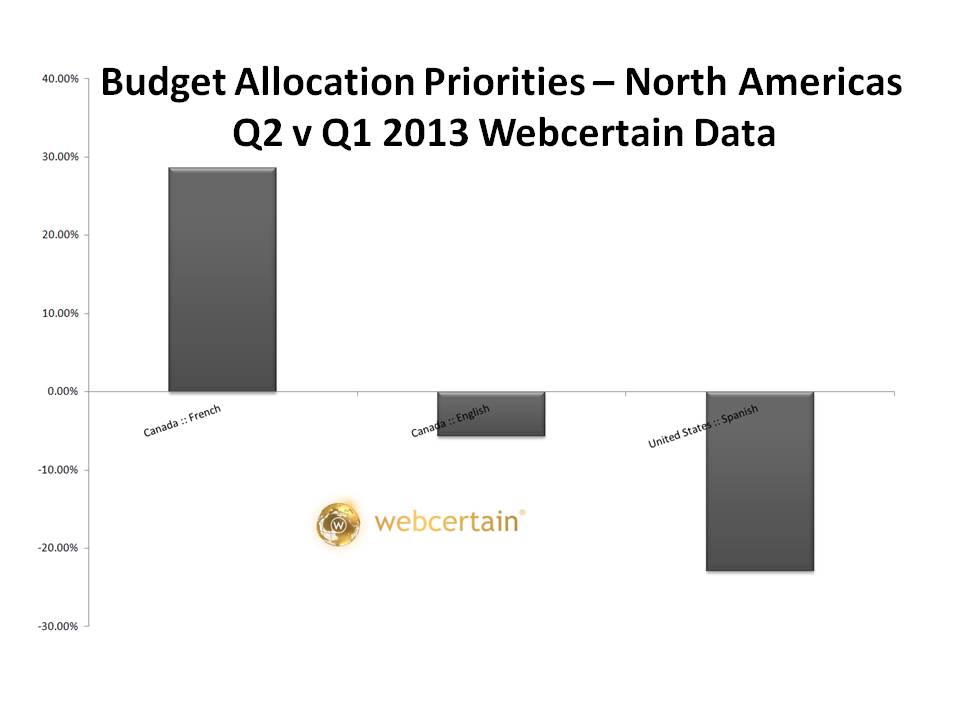

Looking first at North America (above), we see some more emphasis being given to Canadian French, at the expense of the US Hispanic market or Canadian English. Behind the scenes, the US has been growing strongly and the additional emphasis placed on Canadian French represents new money invested. This case is more about filling the gaps in a North America marketing plan on the back of some signs of better economic conditions.

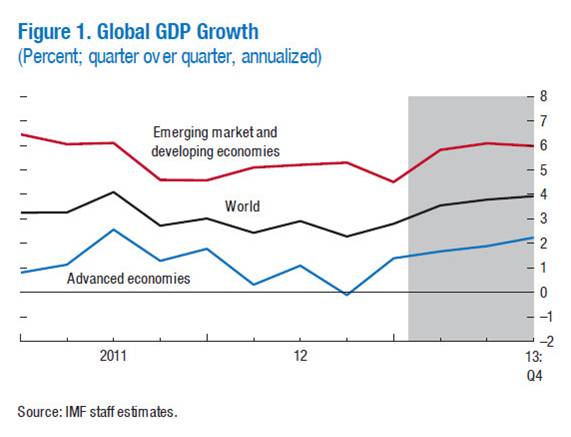

The IMF chart above usefully divides the world into Emerging Markets And Developing Economies, the world and then Advanced Economics. It is quite clear that in the first quarter of 2013 the advanced economies saw a significant dip, whilst emerging markets benefitted – which we also see in the online marketing allocation data. The rise in advanced economies and dip in emerging we expect to be reflected in the Q3 figures.

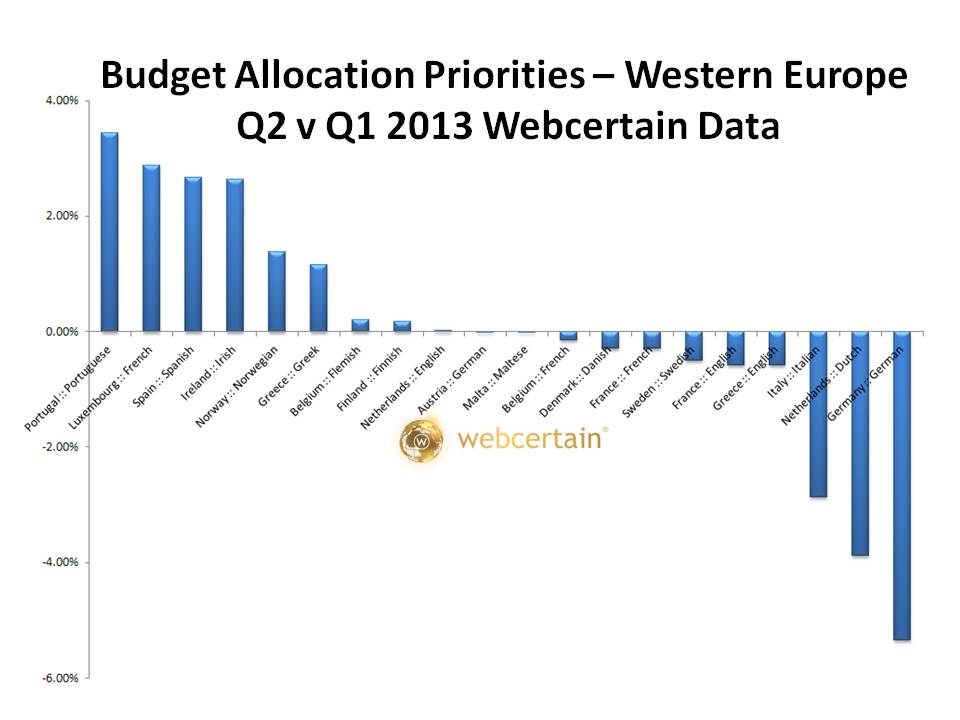

In Western Europe, the advanced economies saw a dip in share of budget allocation especially Germany and the Netherlands whilst economies you might expect not to appear at the top of the list such as Greece, Portugal and Spain. (Luxembourg in this data is an anomaly we expect to drop out in the next quarter). Bearing in mind that this data ia about re-allocation of budgets, the reason for the prominence of Portugal, Spain and Greece is a correction after a year of very limited investment in these Mediterranean nations.

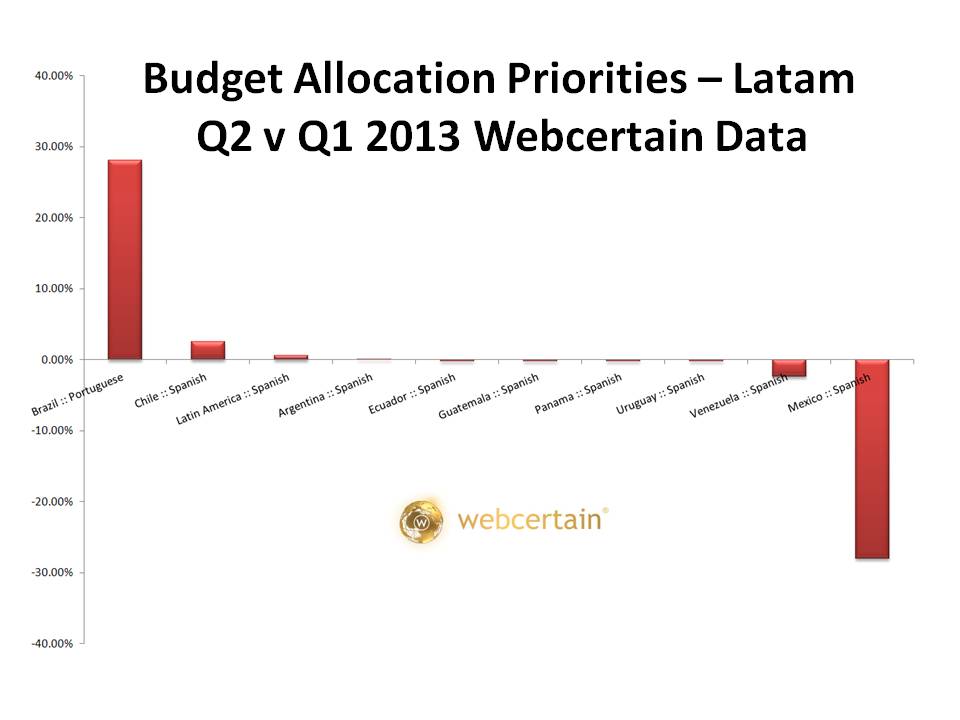

Globally, the Latam region lost some share but within the region itself we see that Brazil is taking a larger slice of Latin American investments and the big loser is Mexico. Mexico has been seeing strong economic growth of above 4% but the future looks a little less rosy with growth expected to dip below 3% in 2013. Another possible explanation behind this pattern is the attraction of doing business in Asia.

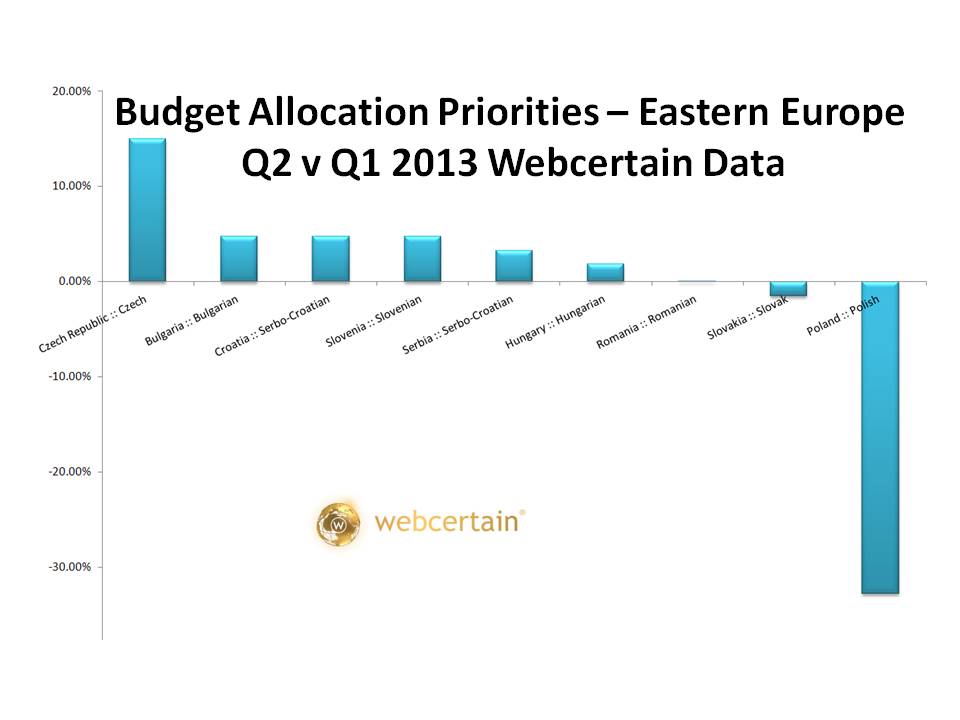

During the more challenged economic times of recent years, Eastern Europe has done well with Poland taking a large slice of investments right through 2012. The smart money in quarter two moved to the Czech Republic, Bulgaria and the southern Slavic states rather than Poland. This was motivated predominantly by successes in Poland which drove businesses to expand their success throughout similar Slavic non-CIS nations.

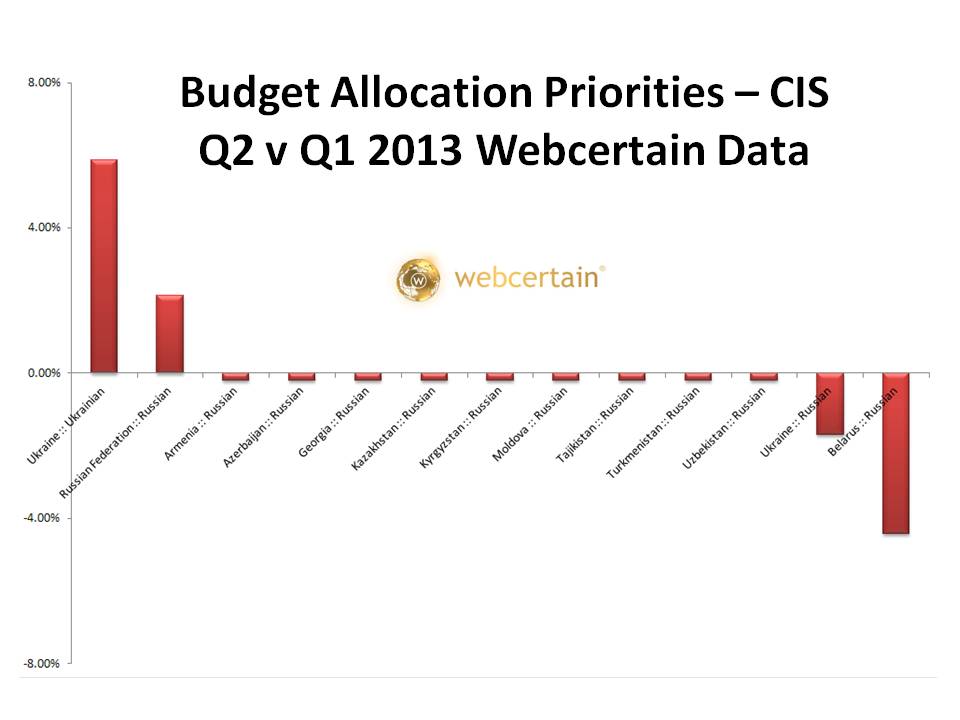

An interesting and yet similar pattern to that in Eastern Europe emerges in the nextdoor CIS states where the Ukraine gained significantly in terms of share in the second quarter eclipsing even Russia’s long held position trajectory. Marketers are also testing the waters in a range of CIS states looking to find attractive markets which their competitors have not yet reached.

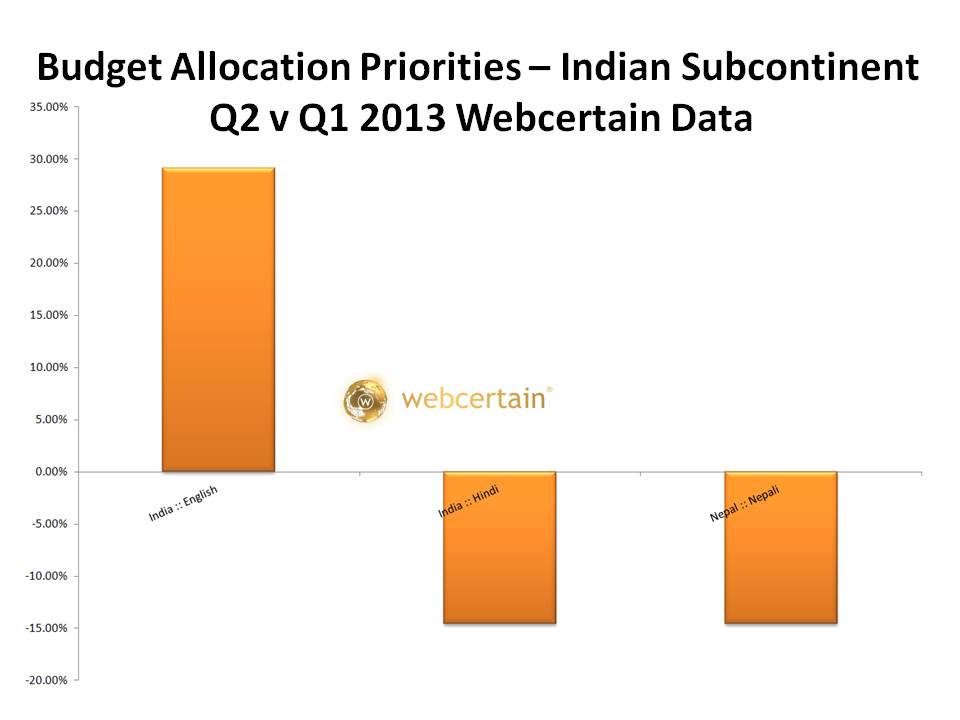

Skipping quickly past the Indian Subcontinent where there is little to report other than that most marketers test using local languages such as Hindi or Nepali (in nearby Nepal) but end up gaining most traction sticking to English. Other nations in the region such as Pakistan or Banglagesh have seen almost no online marketing activity during both quarters.

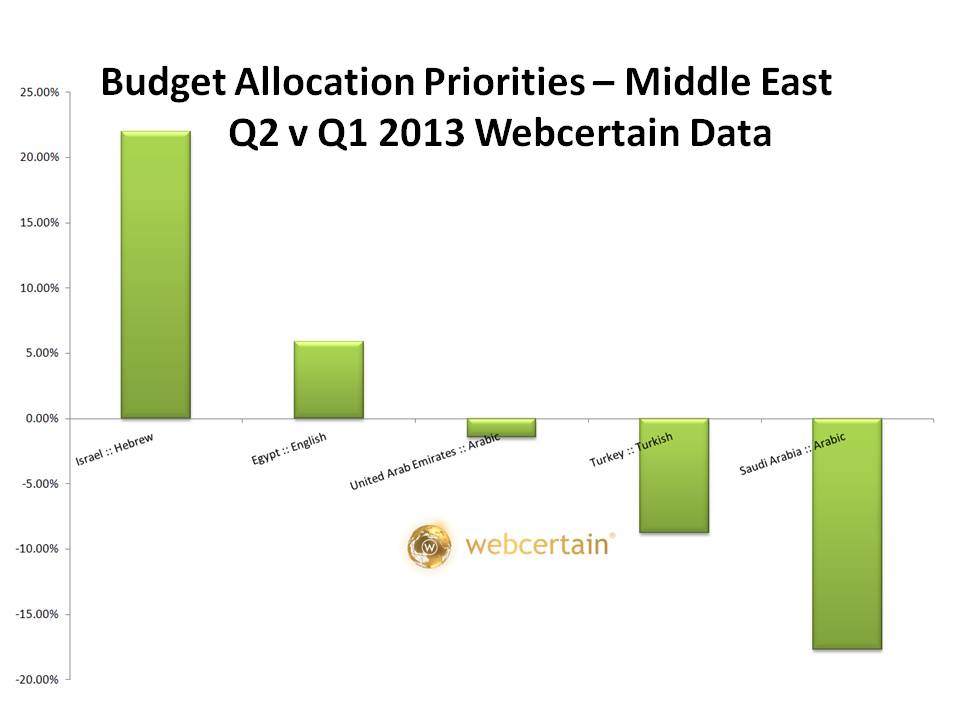

The Middle East is a very frustrating region for marketing folks – rich in resources, hungry for western products, increasingly moving online and under-served by many big brands, the marketing world should be beating a path to do its door. Unfortunately, the Arab Spring, Lybia and Syria conflicts as well as internal strife in formerly useful markets such as Tunisia and Egypt have been holding things back.

The clearest explanation for the current quarterly movement seems to be heading towards Israel as a relatively “safe” haven in the region with little likelihood of internal troubles aside from the Palestinian problem – and even there moves are afoot to improve things. However, this is also a region where activities move around quickly and the pattern may well be very different by the end of 2013. Egypt is the largest Arab-speaking market in the world and if the current horrific troubles were to subside, it would likely suck in resources very quickly.

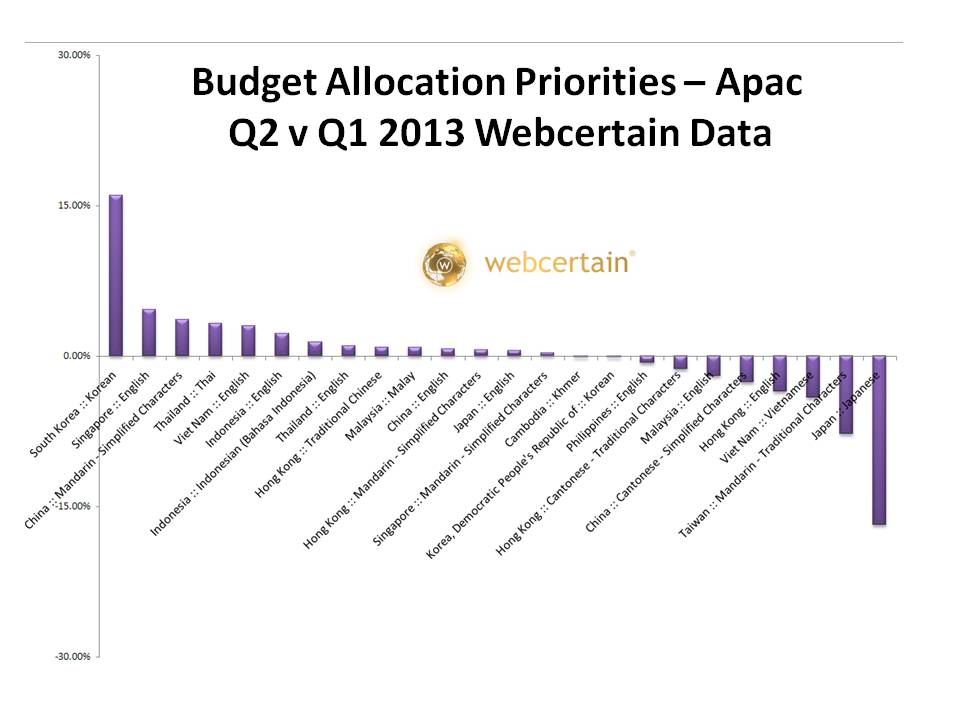

The sheer diversity of the Apac chart gives us the idea of the degree of movement in this direction. Marketers are dipping their toes into as many Asian markets as their budgets will allow with only really Japan and Taiwan (more of those advanced economies) looking challenged.

Most significantly, China is a key destination but the level of marketing interest in South Korea is also astounding. Much smaller than China, South Korean is currently witnessing a rush to get in the door. Partly this is due to its role within Asia as a relatively advanced and stable economy, but still in Asia.

Meanwhile some of this South Korean success has to be attributed to the recent success of both Naver and Daum who have reinforced their positions. A somewhat shaky start to Naver’s relatively recently launched advertising system is now well behind us. In China the big winners to this trend are Baidu and now Qihoo 360 which has seen a rapid uptake from experienced western marketers.

Andy Atkins-Kruger

Latest posts by Andy Atkins-Kruger (see all)

- Launching our new concept – Webcertain In-house! - July 26, 2019

- Yes, the robots are here and they’re running Google Ads! - April 10, 2019

- Be prepared: A personal message from Webcertain’s CEO - May 15, 2018

[…] welche Regionen lohnt es sich zu investieren? In welche Regionen investieren andere? Eine neue Studie von Webcertain gibt darauf Antwort und zeigt, wie sich die weltweite Budget-Verteilung im Online-Bereich vom […]