If you have taken a course in intercultural understanding at some point in your life, chances are you have come across Geert Hofstede and his four dimensions of national culture (see below). The model, which now contains individual reporting on 93 countries, can especially prove useful for smaller and less resourceful businesses contemplating international expansion. Blindly relying on the data, however, is not the way to go.

*Note: This post will not explain the different factors in-depth, but you can read about them here. An additional two dimensions have since been added to the cultural framework based on research carried out by other people (Long-term vs. Short-term Orientation and Indulgence vs. Restraint).

Reduce the margin of error when expanding internationally

Ideally, you would want to undertake thorough market research prior to expanding into new territory. And by thorough, just to clarify, I am referring to conducting field research (in addition to secondary research) that aims to identify attitudes towards your specific products/services within your target group in the local market. A few important questions to ask include:

- Is there even a local demand for the product we offer?

- How do we stack up against existing competitors (from a consumer’s perspective) in the local market?

- What are the underlying needs of our target audience in the local market?

- Does our product meet those needs or does it need tweaking to fit local preferences?

- Many more…

Unfortunately, the above approach is often not feasible for purely economic reasons. In reality, most SMEs approach international expansion on a trial-and-error basis whereby products and services are slowly rolled out and insights gained along the way from the experiences made in the local market. This is a perfectly acceptable approach if resources are scarce by the way. And that is exactly when Hofstede’s research comes in handy.

True, the data is quite unnuanced and provides only a rough breakdown of existing cultural differences between countries. Moreover, as is pointed out by Hofstede et al., there are considerable differences between individuals within a society (country). Nonetheless, this freely accessible data serves as a great guideline tool for quick exploration of the prevailing norms and paradigms in a given country which can help in shaping your strategy and reducing the margin of error when taking your business to foreign shores.

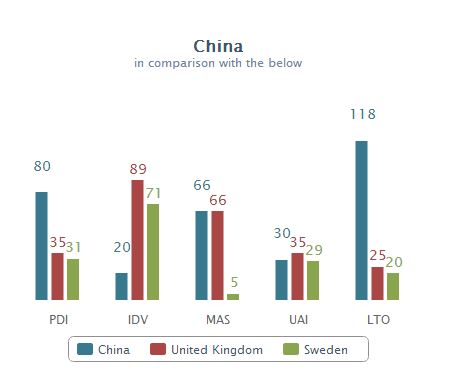

Country comparison: China vs. Sweden vs. UK

A simple country comparison between China, Sweden and the UK immediately unveils outspoken cultural differences and belief systems. While Sweden and the UK overall are fairly similar (with the clear exception of the Masculinity versus Femininity factor), Chinese culture is strikingly different on most metrics. For instance, inequality and hierarchies between people are accepted by the Chinese as inevitable structures of society, notably different from the views in both Sweden and the UK. China furthermore is a hyper collectivist society in which life is largely dictated by the group, rather than the individual – again sharply contrasting to the way of life in our two European countries.

However, even for seemingly similar countries, subtle but important differences often exist. Sweden’s highly feminist society, for instance, greatly deviates from the UK, as maintaining life/work balance, equality and solidarity generally have greater weighting than masculine factors like competition, achievement and success.

Make use of it, but do so with caution

Your ability to adapt product development, communications and marketing strategies etc. to fit local belief systems will greatly impact on your business performance. Hardly any revelation, I know. But Hofstede’s data will hopefully help you in that process. Just beware that this data is not the holy grail and that it surely will not provide you with a deep understanding of what triggers your target audience in the local market. It will, however, scratch the surface… and that is certainly a far better starting point than taking a stab in the dark.