Yandex, Russia’s leading search engine, recently disclosed its Q1 2012 financial results. Results exceeded analyst expectations, with revenues up 51 percent to $200.3 million, and net income up 53 percent to $43 million. Surely, such figures would make most company executives jump up and down, however, digging into the figures makes one question whether this apparently positive financial performance is actually worrisome from Yandex’s perspective?

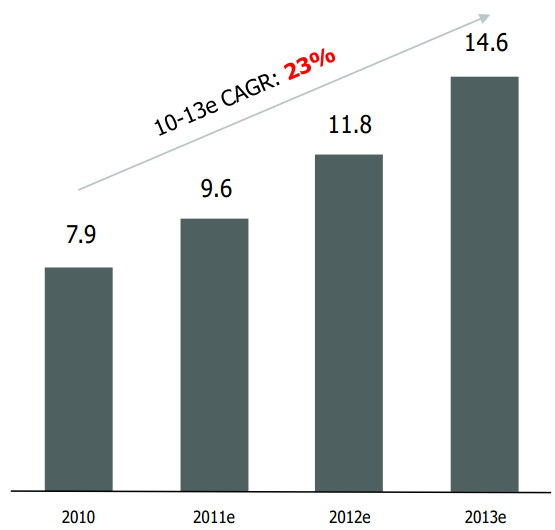

Despite exceeding analyst expectation, could or should the figures be even higher? Firstly, it’s important to keep in mind that the Russian internet is growing at a massive pace which — needless to say — has a positive effect on online advertising platforms in the vast country. In fact, Russian online advertising expenditures were up 56 percent in 2011, with the biggest gain coming from contextual ads, up 63 percent and no sign of stagnation in 2012. In other words, it appears that Yandex’s Q1 2012 revenue increase is actually below that of the overall market.

Russian Online Ad Spend % of Total Ad Market

Source: Yandex

Is Google gaining traction at the expense of Yandex

What’s particularly noteworthy is the fact that contextual ads have seen the highest overall gain. That’s Yandex domain, with text-ads still accounting for 90 percent of its revenues, notes Ingrid Lunden. This indicates that competitors are eating into Yandex’s share of the market. Lunden further notes:

“Yandex’s share of the search market in Russia, its largest market by far, is now at 59 percent against competition from Google and others: last year it was close to 65 percent (…) Before today, Yandex had been trading down amid concerns that competitors (mainly Google) were gaining market share on the company in the search advertising market, an area where Yandex in the past had enjoyed a healthy lead.”

Russia is one of the few bastions left for Google still to conquer. Although the Mountain View, California-based company still hasn’t succeeded in its efforts of doing so, stealing 4-6 percent market share from homegrown Yandex in one year is rather significant. My fellow columnist and Editor-in-Chief of Multilingual-Search, Andy Atkins-Krueger, last year wrote a piece on Search Engine Land about where Google was investing its international marketing spend and basically indicated that the company was pumping money into the Russian market in order to break down Yandex’s stronghold. Along the lines it said:

“Despite their vast spend in Russia, Google does not appear to have moved the Russian market share needle against the leader in the market , namely Yandex which has actually been claiming share gains during the same period.”

Well, it appears the effect might have started to kick in. Because Yandex has proved resilient to Google’s many attempts to challenge its dominant position up until now, this has allowed the company to allocate resources to look beyond Russia for expansion. Although it’s still too early to conclude anything, it poses the question: Will Yandex take stock of the situation and how will it affect its expansion plans?

Two potential scenarios

Turkey was the first (obvious) choice outside of the CIS-region and Ilya Segalovich, CTO of Yandex, told the WSJ Europe yesterday that the company aims to claim 20-30 percent of Turkey’s total search engine traffic, although it currently has less than 1 percent of the attractive market. Expanding into Turkey has proven quite resourceful due to the language barrier, meaning that “Yandex has had to redesign all internal procedures and the parts of the engine to be worked with people who don’t know Russian”, Segalovich said. During the interview, he also hinted that further expansion was highly likely and suggested other European countries as future potential targets.

However, Yandex’s expansion plans are fuelled by profit made in Russia – and if Google keeps eating into its market share in its by far largest market, there are two potential strategic scenarios;

1) Penetrating the Turkish market and expanding into new ones will be put on hold to concentrate fully on defending its home turf.

2) Expanding marketing efforts and headcount to defend its home turf while penetrating Turkey and expanding into new markets.

Is it just a matter of time before Google reigns supreme in Russia as well, or does Yandex have what it takes to combat Google and stay on top in Russia?

Business Development Director of Yandex, Preston Carey, will be speaking about making it in Russia at the International Search Summit @ SMX Advanced in Seattle on June 7th. Tickets are still available.

Immanuel Simonsen

Latest posts by Immanuel Simonsen (see all)

- Is Baidu losing its crown in China? - July 31, 2015

- Global logistics brand DHL eyes Chinese e-commerce growth - July 27, 2015

- VKontakte To Launch Rival To Instagram - July 21, 2015