Keeping track of trends in an ever evolving digital age and gathering reliable data to inform business decisions can be a time-consuming and often times expensive undertaking.

As this even holds true for companies that operate in a single-market, you can probably imagine the complexity that piles up when catering to an international audience.

Luckily for you, I’ve compiled 5 key insights from comScore’s recently published Europe Digital Future in Focus 2013 report, which contains a treasure trove of insights into how Europeans navigate the digital landscape across devices and web properties.

If you do business across Europe, I strongly recommend you to go download the full report, but for now let’s take a look at a few particularly interesting findings.

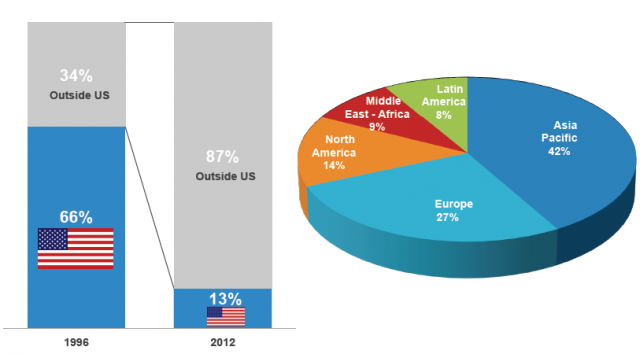

1. The global perspective – international markets make up an ever-larger chunk of the global web

The US’ global digital domination has been waning rapidly over the past decade and a half. As of December 2012, comScore estimates that US internet users make up a ‘mere’ 13% of the global digital audience, compared to 66% back in 1996.

Moreover, while the US remains the world’s single-largest ecommerce market at the time of writing, various reputable sources find that China is on track to surpass the US as the global leader later on this year.

Expect this trend to intensify as the internet really starts to pick up in developing and emerging countries.

Source: comScore Europe Digital Future in Focus 2013

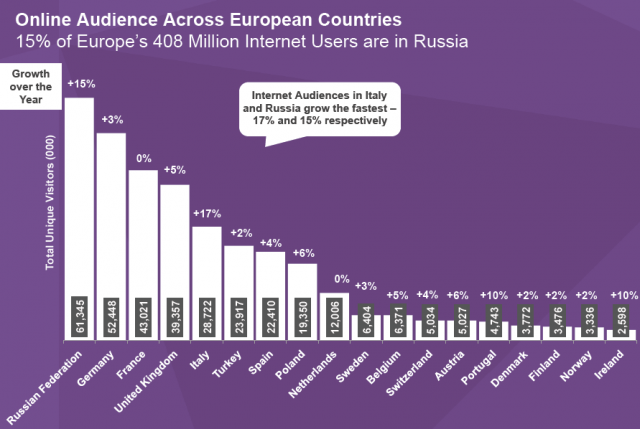

2. Russia solidifies its position as Europe’s biggest online market by user count; Watch out for Italy

Only outpaced by extremely strong internet adoption growth in Italy, Russia distances itself as Europe’s largest internet market by user count, up 15% over December 2011. Internet penetration in Russia, however, is still modest and further underlines the market’s great potential.

Source: comScore Europe Digital Future in Focus 2013

Much like Russia, Italy has been off to a slow start in terms of digital adoption, yet it’s somewhat surprising that the boot-legged country comes out as Europe’s fastest-growing online market. But despite last year’s rapid growth, Italy’s online population remains significantly smaller than similarly sized countries like the UK and France.

Additionally, and perhaps a more interesting metric, eMarketer research shows that while a lower percentage of the Italian population may be online compared to some of its comparable European neighbours, average spend per online buyer is second only to the UK in Europe. Now, couple this apparent willingness to spend big with modest internet penetration (still sitting below 50%) and you’ve got yourself some potential.

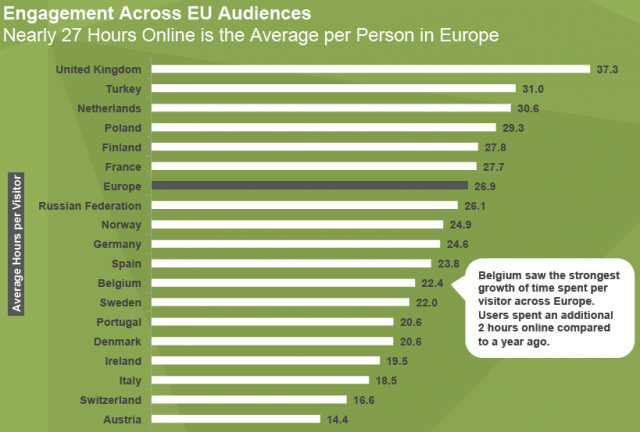

3. The UK is +10 hours ahead of European average in terms of engagement; Turkey once again among top 3

The UK consistently takes up the top spot as Europe’s most engaged online audience in terms of time spent online. In fact, UK netizens spend as much as 10.4 hours more online per month than the average European.

Also, for those of you who haven’t followed comScore’s ongoing tracking of the European digital landscape, it may come as a surprise that the UK is followed by Turkey in second place.

This is not an isolated case, though; Turkey has for quite some time been among the top three European nations for online engagement.

Source: comScore Europe Digital Future in Focus 2013

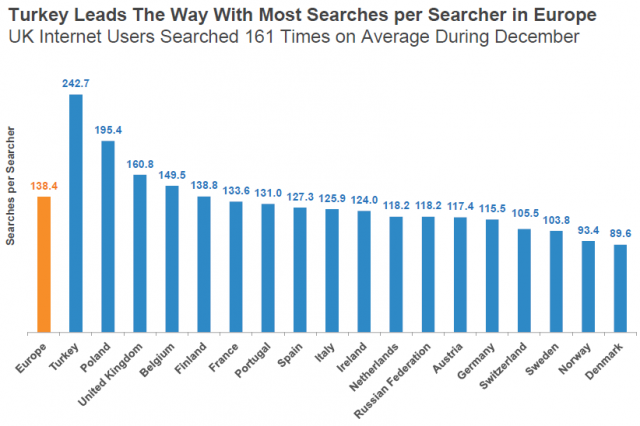

4. Vast differences between Europeans when it comes to ‘search frequency’

If you’re a frequent reader of this blog, you’ll know that search patterns often differ tremendously between countries. Normally, authors will point to language constructs, regional language usage and culture as differentiating components – all of which are indeed valid in their own right.

However, turns out the frequency with which Europeans search also greatly differs.

In this regard, the average online Turk conducts almost 3 times as many monthly searches as the average connected Dane! And more interestingly perhaps, the amount of time people spend online doesn’t always correlate with how many searches they carry out.

To stick with Turkey, its online population appears to make a disproportionately high amount of searches – even when factoring in their high online engagement. Conversely, people in the Netherlands are well below the European average in terms of monthly searches, despite being among the top 3 most engaged online populations. If you take a closer look at the data, you’ll find that there are many such deviations.

Source: comScore Europe Digital Future in Focus 2013

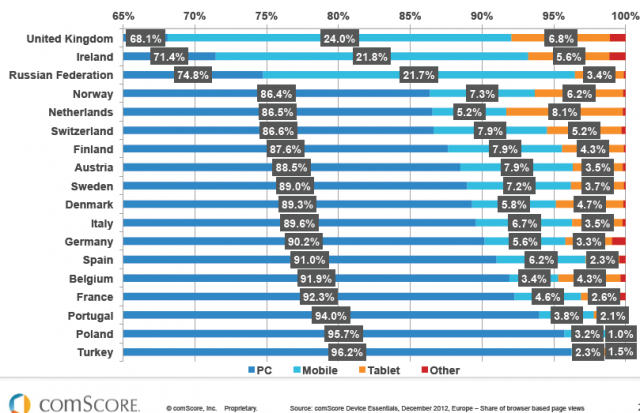

5. Cross-device usage remains super fragmented

A topic of great interest in marketing circles these days is cross-device media consumption. And for good reason!

Unfortunately, however, the far majority of articles out there don’t go deeper than the “multi-platform is huge – get on or get left behind” sort of approach. That’s a shame since comScore’s data indicates that, while consumers in general are becoming more platform agnostic, the extent to which multiple devices are shaping the online experience remains hyper fragmented.

For example, if you’re targeting the UK, it’s indisputable just how critical a multi-platform strategy will be to achieving your business goals. Heck, nearly one third of all UK page views in December last year were on mobiles and tablets!

However, out of the 18 European countries for which comScore provides individual reporting, only three are seeing more than 20% of total internet traffic being generated by mobiles and tablets. In Poland and Turkey, for example, more than 95% of all traffic is being driven by PCs.

Now, should this impact on your approach to multi-platform on an international scale, I’ll ask you rhetorically?

Device Share of Page Views Across Countries in Europe

Source: comScore Europe Digital Future in Focus 2013

As always, over to you. Are you surprised by any of these findings? Do they correlate with other data you’ve come across on the web? What’s your own experience in dealing with European markets? Best practices? Pitfalls to look out for? It’s all up for debate in the comments section below.

Immanuel Simonsen

Latest posts by Immanuel Simonsen (see all)

- Is Baidu losing its crown in China? - July 31, 2015

- Global logistics brand DHL eyes Chinese e-commerce growth - July 27, 2015

- VKontakte To Launch Rival To Instagram - July 21, 2015

[…] 5 Key Insights from comScore’s 2013 Europe Digital Future in Focus Report […]