The rise of Facebook is taking the world by storm. As of Q4 2012, the GlobalWebIndex reports that Facebook had nearly 694 million monthly active users worldwide, and that, thanks to the massive growth in mobile usage, there is little risk of “Facebook Fatigue” closing in anytime soon.

But for all the talk of how effective social media is at allowing brands to engage with customers, search still plays a pivotal role in consumers’ brand discovery and purchase decision making process. Its relative importance, however, varies significantly by market as we have discovered using what we here at GWI call the Brand Discovery Index (BDI).

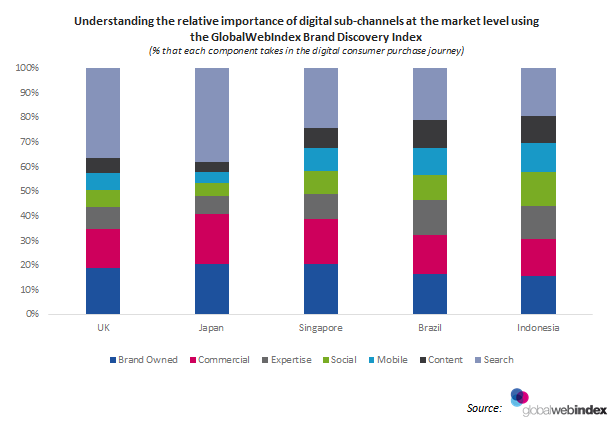

Full details on the BDI will be available in the coming weeks, but it is important to note that using this metric, we are able to understand not only the importance of digital vs. offline channel in the purchase journey but also the importance of each subcomponent within these channels. What the chart above is showing us is the relative importance of each type of content within the digital purchase journey within each country.

Search alone most important in advanced internet economies

Perhaps the most striking aspect of the chart above is the relative importance of search vs. other digital mediums in the advanced internet economies of Japan and the UK where search accounts for 45% and 42% of all brand discovery online respectively. This contrasts with Indonesia and Brazil, for example, where other digital channels are having similar impacts to search when it comes to discovering and researching brands online.

The other striking factor is how much of a role owned digital properties (brand websites and email marketing) as well as commercial factors (consumer reviews, branded forums, price comparison sites, etc.) play in the UK and Japan alongside search. These three channels compose the majority of channels used by consumers in these markets.

These insights will obviously vary the more we dig into specific target demographics in each market, but the most important thing to consider is how we make search work with the other two key channels. This sub-component breakdown essentially provides a benchmark against which you can analyse your current digital channel strategy.

Integrating multiple channels is key in emerging markets

Perhaps the most interesting aspect for many of us is what is happening in emerging markets, and as we can see, search does not hold near the dominance over consumers in these markets. That is not to say it is not an important channel. On the contrary, it is likely to be the most important channel because of the way it links all of the other sub-components together!

It is also in the emerging world where digital plays a much more important role overall. As opposed to the advance internet economies, what is on the other end of that search, the content, mobile, and social offerings, will play a much larger role in the ultimate decision.

In these markets, internet users are much less brand loyal than what we see in places like Japan and the UK, and this gives us a tremendous opportunity as marketers if we get our digital strategy right from the outset in these burgeoning economies. We have the chance to capture hearts and minds now, so let’s not waste it!

Brett Petersen

Latest posts by Brett Petersen (see all)

- 3 reasons why Google Now is Google’s future - June 6, 2013

- China leapfrogs the world in social commerce - March 7, 2013

- Emerging vs. mature internet markets: Variations in brand discovery process? - February 14, 2013