In an article published this week, Diane Mermigas stated that “Facebook’s developing social search framework will be a catalyst for redefining and monetizing mobile, unleashing a torrent of new revenue and value that eventually will make its $100 billion IPO valuation look like child’s play.”

Mermigas argues that Facebook’s endless source of personalised information is its competitive edge and what could ultimately set it apart from Google and even surpass the world’s currently undisputed search champion.

That’s an extensive debate which won’t be covered in this piece; however, one could be forgiven for questioning whether Mr. Zuckerberg’s ubiquitous social network is even worth its expected $100 billion valuation prior to the company’s forthcoming IPO when reviewing this week’s S-1 filing.

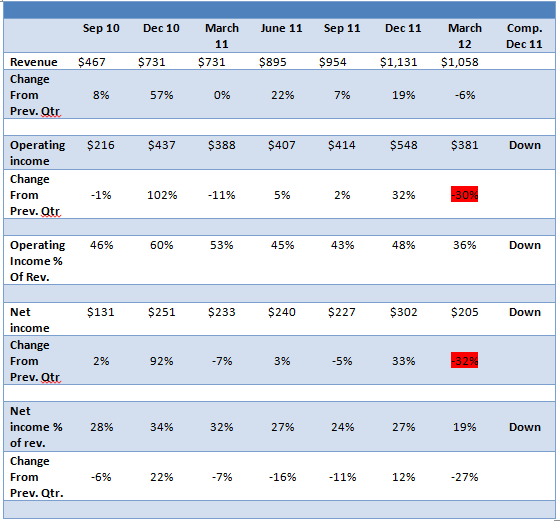

Facebook’s Q1 2012 revenue might be up 69 percent from the same period last year, yet operating and net income are the lowest since September 2010. Obviously, this is indicative of heavy investments made by the company. For instance, the number of full-time employees rose 46 percent from last year to 3,539, notes Christopher Heine. Growth is now almost entirely happening in emerging markets, where revenue per user has proven lower compared to mature markets — and expenses connected to fuelling expansion in those markets through increased headcount and maintenance have been rising at a faster pace than revenue.

Fuelling future growth or first signs of declining profitability?

Let’s just look at the international perspective for a second. Facebook’s stated mission is to make the world more open and connected – a mission it certainly lives up to. The social giant now claims it has more than 900 million users globally, of which a staggering 532 million are daily active users. Having this kind of scale, combined with highly personalised information on every single one of its users across almost all markets, do indeed give Facebook something no one else has, as Diane Mermigas argues. In short, Facebook becomes the place to go to for any international advertising campaign.

In addition, Facebook has seen astonishing growth rates in key future markets such as Brazil and India. While expenses might exceed the relative revenue increase when penetrating those markets, this is unlikely to be the case a couple of years from now as Facebook penetration will grow and emerging markets generally become more economically attractive.

However, the question still remains: Is Facebook simply building the foundation for future growth or are we witnessing the first signs of decreasing profitability?

Source: Seeking Alpha