New research conducted by IDC’s Worldwide Mobile Phone Tracker found that in Q4 2012 Android & Apple (iOS) increased their dominance of the Global Smartphone Operating System Market, with a combined share of 91.1% compared to 75.9% combined in Q4 2011. This marks a critical moment for the global smartphone and OS ecosystem, posing speculation as to where the seemingly runaway leaders go from here and how other Operating Systems can catch them.

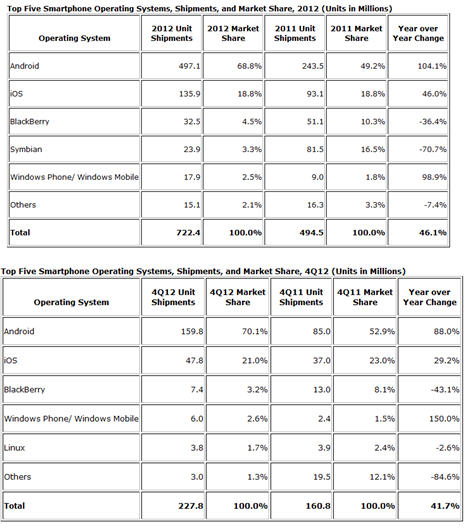

Given the diversity of smartphones available, it’s hardly surprising to see Android remain on top, with a 68.8% share of the 722.4 million devices shipped in 2012, which is a 104.1% increase on 2011. Q4 2012 actually saw the Android share hit 70%, which is a huge year on year increase of 88%, compared to Q4 2011.

Despite the highly publicised Maps debacle, demand remains strong for the iPhone 4 & 5 and Apple maintains an 18.8% share of the Global OS market, shipping 135.9 million units in 2012. Given this is an increase from 93.1 million units shipped in 2011, this should go part way to dispel the myth that iOS is struggling for growth. The last quarter of 2012 actually saw iOS capture 21% market share with an extremely good Christmas period under the belt. Even so, this share is slightly down on the 23% the Cupertino-based company posted in the last quarter of 2011.

Trailing in their wake, we have BlackBerry in 3rd place, with a 4.5% market share, shipping 32.5 million units in 2012 but down an alarming 36.4% on 2011.Worse still, that market share slipped to 3.2% for the last quarter of 2012, a year on year decrease of 43.1%. BlackBerry has sought to fight back with a new OS and smartphone, released in only a few select markets, however on examining the BB10 one cannot help but think this is too little and about 5 years too late.

Hot on the heels of BB are Microsoft, who launched their new Windows 8 OS during Q4 2012. The initial findings are good, with a market share of 2.6% during that quarter and 6 million shipments worldwide means a 150% increase compared to the same quarter in 2011. If this continues, we should see Microsoft inevitably supplant BlackBerry by claiming 3rd place during Q1 2013.

The big question is; where do they all go from here?

On the face of it, Android should still continue surfing the waves of success brought by a long list of vendors using their OS as a key part of their strategies. Android has also seen a rapid expansion of share in key developing nations and far eastern markets such as China, Japan and Korea. However, the biggest risk to Android is the relationship with Samsung, which contributed a whopping 42% of all Android shipments in 2012. And that relationship appears to be souring already, with Samsung seemingly prepping up a big push behind its Tizen mobile OS. Indeed, if any company were to pull off a significant overnight entry into the Android-iOS dominated mobile OS space, it could very well be Samsung. Developing an OS experience of their own makes even greater sense when considering the company’s healthy shares of the tablet and Smart TV markets. Are Google and Apple trembling? They surely have reason to.

Although comfortably in 2nd place, Apple will no doubt be contemplating how to reverse the deceleration in growth. It’s likely we’ll see the timely release of the iPhone 6 this year, rumoured to have a larger screen and possibly near field communications capabilities, but this is nothing more than speculation. If so, it should appease some Apple fans, but how does Apple address expanding their universe into new market segments and developing nations? The most obvious solution would be to develop a cheaper model or slash the price for the iPhone 4 to attempt an assault on the Android user base.

BlackBerry faces a difficult task in trying to convince customers to upgrade and lure away Android and Windows users, but given the rather subdued reception of their BB10 and the fact they have no partners to work with, they face consolidating their position as a niche OS and smartphone at best, but quite possibly the final year for them. Perhaps a sign of how bad things are for them, is that once popular in emerging markets, which are currently driving mobile growth globally, are no longer a priority for them, instead choosing to focus on the UK and Canada (along with the Middle East).

2013 will also be a critical year for Windows, albeit with a strong start on the back of their solid relationship with Nokia, the main challenge will be trying to convince other smartphone manufacturers to adopt the Windows 8 OS. To quote a rather optimistic Ryan Reith at IDC, “There is no question the road ahead is uphill for both Microsoft and BlackBerry, but history shows us consumers are open to change. Platform diversity is something not only the consumers have asked for, but also the operators.”

It will be interesting to see how 2013 unfolds, particularly whether Samsung’s upcoming launch of Tizen will turn the global OS market into a 3 horse race.

Let me know if you think I’ve missed any other potential eventualities or what you think might lay ahead for the ecosystem this year.